epf withdrawal for house

Any proof of relationship must be submitted with transfer of house ownership based on love and affection subject to immediate family members only. One can withdraw up to 3 years of the basic pay and dearness allowance or may be the.

When And How Can You Make Withdrawals From Your Provident Fund Contribution

Up to 90 of accumulated.

. Check out types of EPF withdrawal forms like Form 19 Form 10C. Know about withdrawal Form documents required benefits taxation and other details of PF withdrawal. As an employee working in a corporate set-up there are several things one would like to know about the Employees Provident Fund EPF.

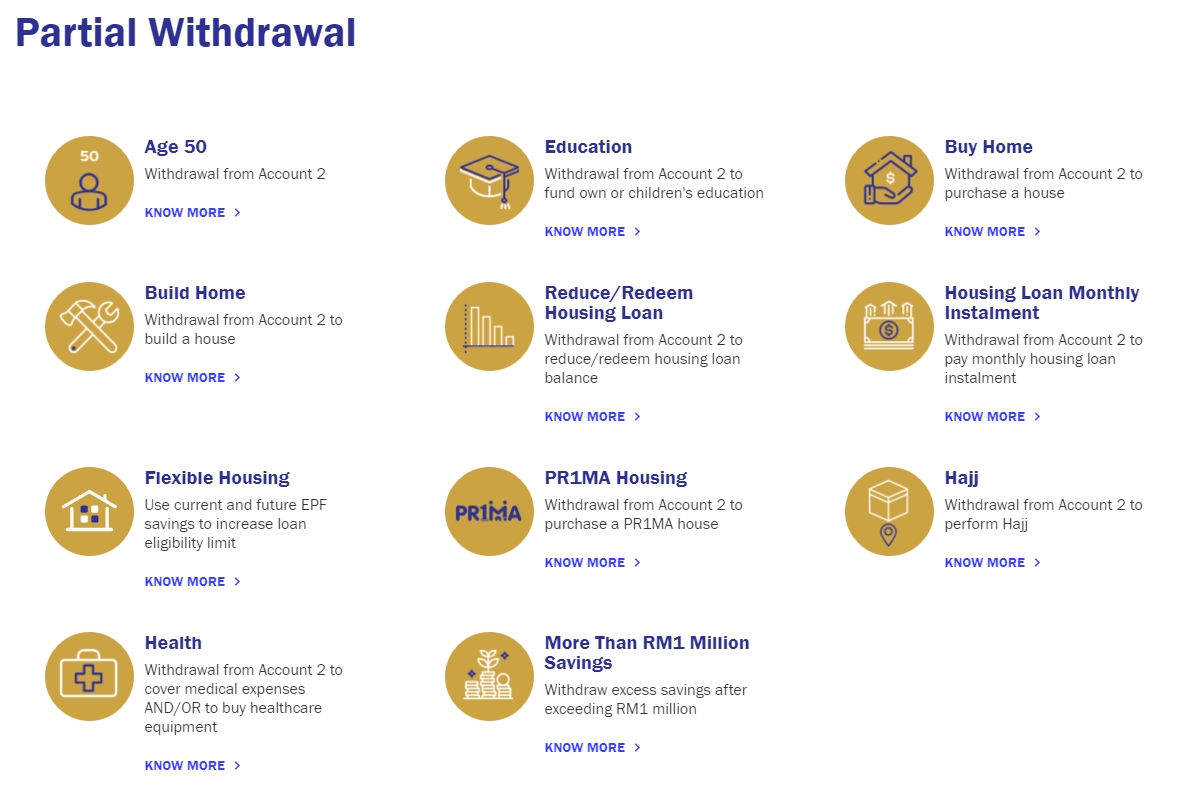

PF can be claimed only once in case of purchasing or constructing a house. You can also withdraw money for funding the construction of your house. Malaysia business and financial market news.

If an EPF balance is withdrawn before 5 years of service TDS is deducted at a rate of 10. Purchase or construction of the house. One can make advance withdrawal of money from their PF account for the purchase or construction of house or flat.

It must be noted that the EPFO makes the contribution directly to the agency private or Public. EPF is the main scheme under the Employees Provident Funds and Miscellaneous Provisions Act 1952. This form can also be used to claim the withdrawal in the case of a minor or a lunatic member.

The Star Online delivers economic news stock share prices personal finance advice from Malaysia and world. Before retirement there is no limit to the. EPF Form 20 is submitted to the EPFO Commissioners office when an EPF member dies.

Therefore one must ensure that other conditions. As per the newly added Para 68-BD in the EPF Scheme 1952 EPF members can apply for a withdrawal of up to 90 of the accumulated corpus for either making the down payment of the house or for the payment of EMIs or for the construction of a new house. After the 10 years of the completion of the house.

You can claim funds in the duration of employment orand at the time of retirement. In March 2020 the government had announced that an individual can withdraw a certain sum from their Employees Provident Fund EPF account if faced with financial stress due to coronavirus and the pandemic-induced lockdowns. An EPFO Employees Provident Fund Organisation subscriber can take an advance from EPF deposits for specific purposes including purchaseconstruction of house and repayment of loan.

The family members can also claim provident fund withdrawal using EPF form 20. News Update 1 st June 2021. When Should we Submit Form 20 PF.

Partial withdrawal before retirement. Check how to withdraw EPF online. Further you can also file TDS returns generate Form.

These rules will come into effect from 12th April 2017. While filing your EPF withdrawal claim online you are required to provide the scanned copy of cheque of the bank account which is registered in the EPFO records. Purchase Construction of House.

Epf Withdrawal Forms Download 5 9 10-c 10-d 13 14 19 Merge two or more PF Accounts with UAN Number. Easy Premature Withdrawal Members of EPF India are entitled to avail benefits of partial withdrawal. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

Withdrawals from EPF Ac for Repayment of Home Loan. Read this article to know more about EPF withdrawal. Similarly if you want to withdraw from your EPF account to buy a house then ensure that you have completed 5 years of service.

The labour ministry has announced that EPF members can now withdraw twice from their EPF account to meet the emergency expenses arising due to the Coronavirus pandemic. Check EPFO portal for Employee Provident Fund Withdrawal Claim Status Transfer Balance. The scheme is managed under the aegis of Employees Provident Fund Organisation EPFO.

EPF withdrawal is taxable under certain circumstances and exempt under certain circumstances. Revised EPF withdrawal rules also allow an account holder to withdraw up to 90 of the accumulated funds after they reach 54 years of age or a year before retirementsuperannuation. TDS will be deducted at the highest slab rate of 30 if PAN is not provided during withdrawal.

To purchase a house flat or to construct a residential property. Halfway withdrawals are permitted if there should be an occurrence of house development disease and marriage. You can withdraw money from your PF account if you are buying a house or a piece of land to build a house.

The maximum PF withdrawal limit in this case is 50 of your share of contribution to PF. PF or EPF withdrawal can be done either by submission of a physical application for withdrawal or by an online application using UAN. Check out types of EPF withdrawal forms like Form 19 Form 10C.

The withdrawal conditions are. To avail this provision you need to submit Loan certificate statement to your employer along with From 31 form for EPF partial withdrawal. List of Epf Withdrawal Form like 5 9 10-c 10-d 13 14 19 etc available at epfindia official website.

To apply for the withdrawal the EPF Commissioner issues a certificate which specifies the monthly contribution by the EPFO member. Over a year later in May 2021 the labour ministry announced that EPF members can avail a second non-refundable advance from their. EPFO allows members to withdraw money from EPF Account twice to meet COVID-19 Emergency.

Get in touch by phone via our online form or by post. The withdrawal amount that is admissible for this reason can be least of. You can claim for partial or full withdrawal of EPF funds in case you have your UAN and Aadhaar Number linked.

Withdrawal Protocols of EPF. Individuals can withdraw funds from their PF account to meet their specific requirements like pursuing higher education constructing a house bearing wedding expenses or for availing medical treatment. To withdraw the PF balance EPFO member wants to submit PF withdrawal form online or offline.

House purchase or construction If you have been in service for 5 years you are free to withdraw up to 3 years of your monthly pay along with the Dearness Allowance for the purchasing or. Kasturirangan says The lump sum complete withdrawal from EPF and EPS account provided number of years of service is less than 10 years can be done at the time of closing of account in the event of job-loss and remaining unemployed for over 2 months or at the time of retirement death or due to permanent and total disability of member. Spouse parents parents-in-law step parents foster parents child stepchild adopted child or siblings Deed of Assignment AND.

The form is submitted by the nominee or the legal. EPF changed certain rules in relation to EPF withdrawal for house flat or construction of property. If you are prepaying the debt loan you should have completed at least 10 years of service.

36 months basic wage plus Dearness Allowance. Each member or employee shall nominate a person in the declaration Epf Form-2 Withdrawal or EPF Withdrawal form conferring the right to the nominated person to receive the benefitamount in case of the death of the member or employee. Tax Calculator Income Tax Calculator Rent Receipt Generator SIP Calculator IFSC Bank Code NPS Calculator Invoice Generator EPF Calculator House Property.

These changes are called as Provident Funds Fourth Amendment Scheme 2017. The EPFO members also have the option to get the EPFO passbook printed and use it as a proof of contribution. Employees Pension Scheme EPS.

Legalais We Legalais Your Concern On The Fake News Facebook

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

Pf Withdrawal Rules Latest Update How To Withdraw Pf Online

I Lestari How To Withdraw Rm500 Month From Your Epf Account Soyacincau

Epf Partial Withdrawals Advances Options Guidelines 2020 21

How Much Can We Withdraw From A Employee Provident Fund Epf During This Crisis Quora

Epf Withdrawal Rules 2022 All You Need To Know

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

Kwsp Housing Loan Monthly Installment

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

Employees Provident Fund Epf Withdraw 90 Per Cent Of The Fund To Buy A House Or Payment Of Home Loan Emi Wealthtech Speaks

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Construction Of House Epf Advance Construction Of House Epf Withdrawal Limit Pf House Construction Youtube

Epf Withdrawal For Housing Loans Reduction To Withdraw Or Not

E Pengeluaran Epf S Online Housing Loan Withdrawals 1 Million Dollar Blog

Think Twice Before You Make A Covid Emergency Epf Withdrawal

You Can Withdraw 90 Per Cent Of Epf Money To Buy House Pay Home Loan Emi Here S How Businesstoday

0 Response to "epf withdrawal for house"

Post a Comment